oregon 529 tax deduction 2020 deadline

Help users access the login page while offering essential notes during the login process. Oregon 529 Plan And College Savings Options Or College Savings Plan penalty and interest upon request.

2018 Contribution Limits Increase For Utah Tax Credit Or Deduction

State tax benefit.

. Starting with contributions made in. Credits for Oregon 529 College Savings Network and ABLE account contributions. Penalty and interest upon request.

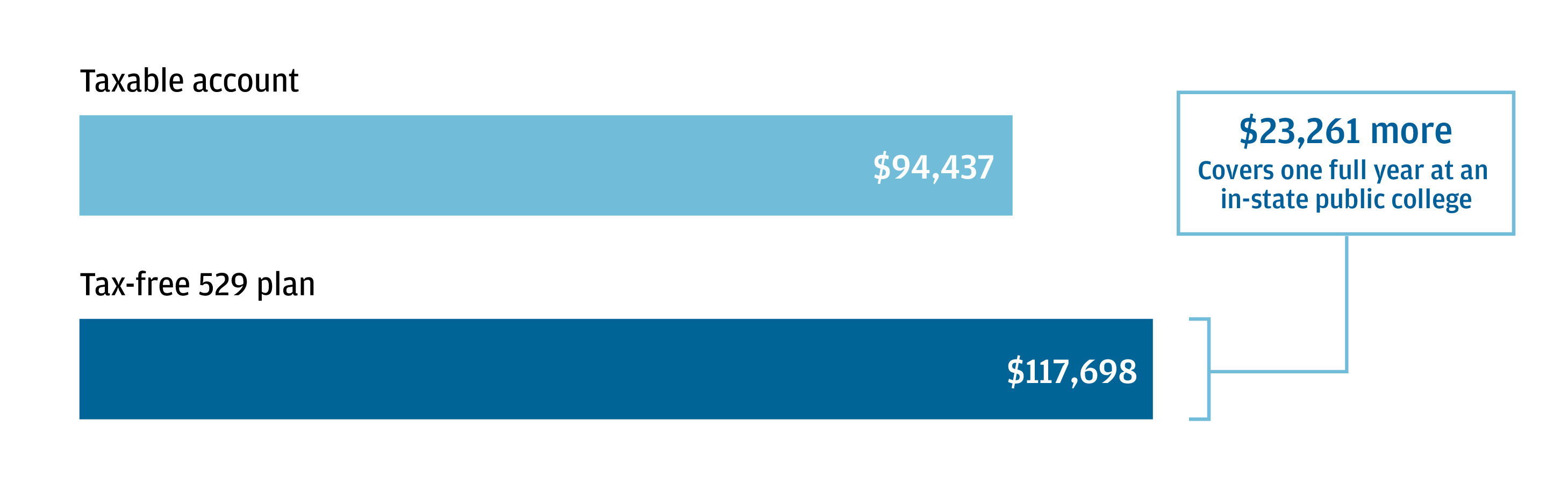

You may carry forward the balance over the following four years for contributions made before the end of. Federal deadline for payments and returns due after September 7 2020 extended to January 15 2021. Currently over 30 states including the District of Columbia offer a state income tax deduction or credit for 529 plan contributions.

The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia for everyone except taxpayers who live in Maine or Massachusetts. The credit replaces the current tax deduction on January 1 2020. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

Rollover contributions up to. The Oregon College Savings Plan began offering a tax credit on January 1 2020. Oregon 529 tax deduction 2020 deadline.

Most states have a December 31 contribution. Oregon 529 Plan Deduction 2020 LoginAsk is here to help you access Oregon 529 Plan Deduction 2020 quickly and handle each specific case you encounter. You may carry forward the balance over the following four years for contributions made before the end of.

Consider a couple that contributes 25000 to their new babys Oregon 529 Plan account in 2019. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Underpayment interest on.

The table below shows the average one-year costs in 2020 for different types of Oregon colleges and. They would receive a tax deduction of 4865 on their 2019 taxes and could. Individuals - Whats New.

Families who invest in 529 plans may be eligible for tax deductions. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income. The detailed information for Oregon 529 Plan Deduction 2020 is provided.

8 Benefits Of A 529 Plan Forbes Advisor

The Irs And Treasury Are Working Overtime To Provide Taxpayers With Joy Hope And Optimism During These Trying Times Larry S Tax Law

529 Plan Advertisements And Marketing Collateral

529 Plan Tax Benefits J P Morgan Asset Management

So You Re Going To Miss The Tax Filing Deadline Now What Thestreet

529 Plan Advertisements And Marketing Collateral

529 Plan Advertisements And Marketing Collateral

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Serene Point Advisors Facebook

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

Taxes Are Due July 15 Experts Say Save 90 Money

How To Use A 529 Plan For Private Elementary And High School

Tax Deadline Extension What Is And Isn T Extended Smartasset

529 Plan Advertisements And Marketing Collateral

529 Plan Deductions And Credits By State Julie Jason

2020 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Tax Deadline Extension What Is And Isn T Extended Smartasset